words Al Woods

Although staring at charts while trading Forex is boring, there are a few patterns to look out for. With these patterns and other signals from various indicators, you can spot trend changes and capitalize on these opportunities to get a huge profit.

Some patterns include the Morning Star and Evening Star patterns. But finding these patterns and using indicators can be tricky, especially for day traders. This is why it is best to invest in Forex Educators programs to maximize your profit.

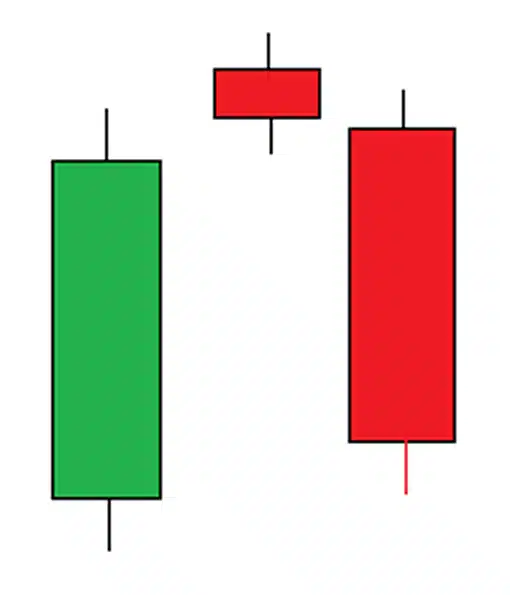

Evening Star Candlestick Pattern

To disambiguate, Evening Star here does not refer to the Evening Star MHW, which is from the video game called Monster Hunter World. The Evening Star Forex pattern contains three candles. The first candle is a large bullish candle, followed by a small bearish or bullish candle, then a large bearish candle. They signal the end of an uptrend and an imminent downtrend. That means this pattern needs to appear at the top of an uptrend in a market with higher highs and lower lows.

The first large bullish candle indicates a large buying pressure, which should continue the current uptrend. Right now, traders should still go long since there is no suggestion of a trend reversal just yet.

When the smaller second bearish or bullish candle appears, the situation changes. This candle is sometimes called the Evening Star Doji candle. It suggests the fatigued uptrend. It does not matter if this candle is bullish or bearish. The small candle suggests that the momentum is slowing down and that the market could go either way.

The third large bearish candle indicates the trend reversal as selling pressure starts to mount. This is when traders should consider going short. After this, the prices will likely continue to go down.

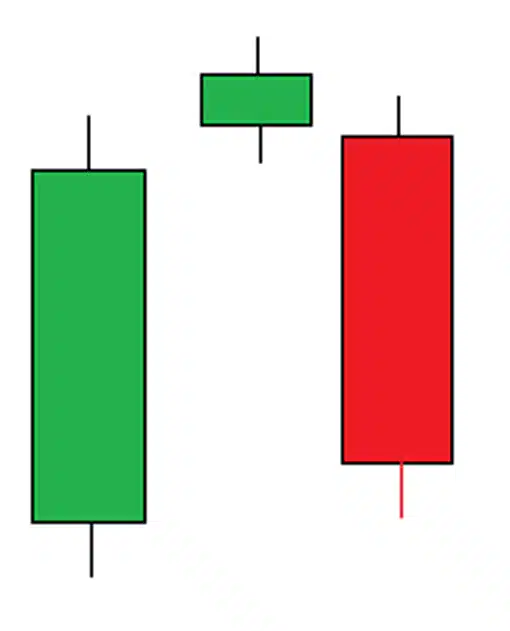

Morning Star Candlestick Pattern

The Morning Star candlestick pattern is the opposite of the evening star pattern. In other words, it indicates the end of a downtrend and the start of an uptrend. Therefore, it must occur at the bottom of a downtrend. It starts with a large bearish candle, followed by a short candle, then a large bullish candle.

Morning and Evening Star Candlestick Reliability

The big question is how reliable are these? What drawbacks are there?

For one, you can see these patterns pretty often in the Forex market. The patterns are very easy to spot on the charts and they give you a clear entry, exit, and stop-loss point. The only drawback is that the reversal could fail and the trend would continue.

For the Evening Star pattern, your entry point would be at the bottom of the third bearish candle. Set your stop-loss above the Doji candle because if the price goes above that level, then it signals a failed reversal. As for your exit point, aim for the previous support level.

The opposite applies to the Morning Star pattern. The entry point is at the top of the third bullish candle. The stop-loss should be at the bottom of the second candle. The exit point would be at the last resistance level.

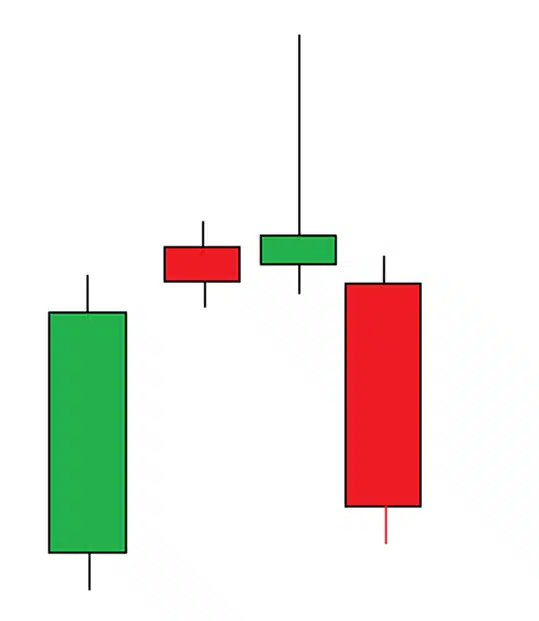

The Shooting Star Candle Pattern

Finally, we have the Shooting Star candlestick pattern. The Shooting Star indicates a bearish trend reversal. It consists of only one candle with a very long wick, which occurs when the price is pushed high but is immediately rejected lower. The upper wick should be at least half the overall length of the shooting star candle itself. In addition, the closing price should be close to the low of the candle.

At a glance, the Shooting Star pattern is very similar to the Inverted Hammer pattern. The difference here is that the Inverted Hammer appears at the bottom of a downtrend and signals an imminent uptrend. The Shooting Star appears at the top of an uptrend and indicates a downtrend.

Similar to the Morning and Evening Star patterns, you can just eyeball it. It is very easy to spot. It is simple, which is why it is one of the trading strategies employed by novice Forex traders. That said, there is one drawback. It is the fact that a single candle may not contribute much to the market movement or the overall trend. You can use this pattern as a confirmation if it appears close to a resistance level or trend line.

The basic strategy is to look for entries to short. First, set a stop-loss at the top of the long wick or at the latest swing high. Then, you have two options. You can take the riskier path and enter on the open of the next candle. Alternatively, you can play it safe and enter around the middle of the wick. This is because the prices tend to creep back up a bit, taking up a portion of the long wick. By entering around the middle of the wick, you keep your stop-loss closer and enter the trade at a much higher price, therefore reducing risk and increasing profit. As for the exit, the basic rule is to go for at least twice the distance of the stop-loss. So if the stop-loss is 50 pips away, at least go for 100 pips of profit.

Trading with the Evening Star and Other Stars

As mentioned before, these patterns are simple yet effective if paired with other indicators. Many novice traders struggle with this strategy not because they could not spot the patterns, but because the indicators are complex.

For this reason, new traders are advised to seek out Forex educators programs to improve their knowledge of the Forex market. It might seem like a big investment upfront, but if you play your cards right, you could be financially independent forever.

One such Forex school you should check out is AsiaForexMentor. Its founder and mentor, Ezekiel Chew, has extensive experience in the market and is a well-known figure in the Forex community. He appeared in many Forex expos and has taught many traders, some of them are now professional traders working in prestigious financial institutions. The course covers many aspects of Forex trading such as the Evening Star patterns and a lot more. Even the free sample you can get on their website contains valuable information that can help you a lot in your Forex trading endeavour.