words Alexa Wang

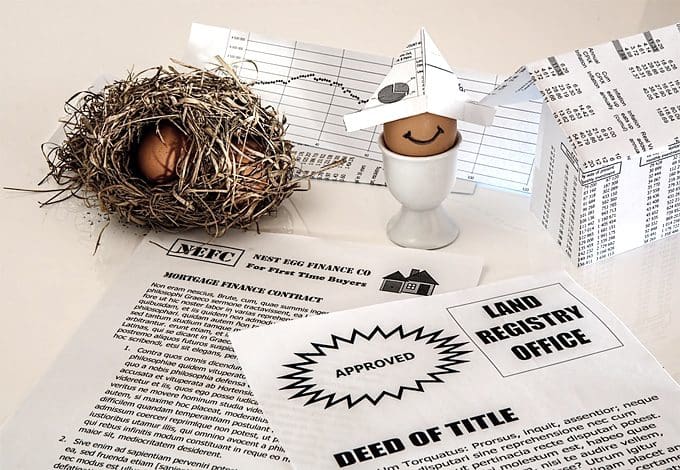

Estate planning is one of those things that many people put off until they are older, thinking that estate planning will only be needed if something happens. In reality, estate planning should be done as soon as possible to ensure the best outcome for all involved parties. This article discusses the do’s and don’ts of estate planning so you can avoid some common mistakes!

Do Get An Enhanced Life Estate Deed

This type of life estate deed is one of the best ways to simplify things upon your death. You have to know that a Ladybird Deed avoids probate when you die which is very beneficial. When you have an estate plan, it makes things much easier to transfer property upon your death.

Make sure the deed is written correctly by getting advice from someone in reality so things will not end up being contested when you die. Don’t assume that just because other people out of town use this type of deed for their own properties then why can’t I? Be sure to seek proper legal advice on these matters before getting one set up for yourself.

Getting a ladybird deed is a great thing to do when getting an estate plan in place. You want things to go smoothly upon your death so getting the right legal advice is essential. This will ensure that everything gets done correctly and you can rest assured knowing everything has been taken care of by getting this type of deed set up with someone who knows what they are doing.

Do Designate Who Will Receive Your Assets

Be absolutely sure that you designate who will receive your assets when you die. This is an important part of estate planning and can avoid many potential problems for your loved ones. If you do not make a plan, the state will decide who gets what- and this may not be who you would have chosen.

There are many different ways to designate beneficiaries for your assets. You can name individuals, charities, or other organizations. Also, it’s smart to set up trusts to ensure that your wishes are carried out exactly how you want them to be. Many opt for grantor retained annuity trusts that allow assets to stay in a trust for quite some time. In addition, you can also consider setting up an irrevocable life insurance trust if you have significant amounts of assets that may be subject to estate taxes.

Whatever method you choose, it is important to keep in mind that designating beneficiaries is one of the most effective ways to avoid probate. Probate can be expensive and time-consuming, so designating someone else to handle this process is usually a good idea. If you do so, make sure that person has no interest in the assets themselves and will not be tempted to take them for themselves or give any away before your heirs receive their portions of the estate.

Do Take Inventory Of All Your Important Documents

There are tons of documents we all have to deal with in our daily lives, from bank statements and credit card bills to DMV documents. But now that you’re taking more time to think about your long-term goals, it might be a good idea to go over these papers as well. These are the types of things that can help make or break an estate plan if they aren’t organized properly:

- Wills (and trusts) – You should always keep copies of both because there may come a time when you need one but not the other; for example, let’s say someone is sick for a while and loses their ability to sign legal paperwork.

- Birth/marriage certificates – These are necessary for creating both wills and trusts, so make sure you have copies handy just in case!

- Powers of attorney – If something happens to you and you can’t manage your own affairs (because you’re sick or injured), someone will need to step in and take care of things on your behalf.

- Health care directives – This is another document that gives directions about medical care if you can’t speak for yourself.

- Funeral instructions – If people don’t know what kind of funeral service they’d like, it’s a good idea to document any preferences so they can be carried out even after you’re gone.

Don’t Procrastinate

You should never procrastinate with your estate planning. In the event of an unexpected death, procrastinating could result in a loss of assets, family feuds, and other legal issues that you would like to avoid.

Do everything in time because procrastinating can have serious consequences. If you procrastinate on writing your will, for example, you might not have the chance to express your wishes about how you want your estate divided. This could lead to family members fighting over assets or even contesting the will.

The best way to avoid any potential problems is by planning ahead and not procrastinating. If you have questions or concerns, consult with an estate planning attorney who can help guide you through the process. Putting off your estate planning is never a good idea, so don’t do it!

Don’t Leave Anything Or Anyone Out

Make sure that you don’t leave anything or anyone out when you are estate planning. In order to be sure that everything goes according to plan, never leave anyone or any asset out of your will. If there is a special someone who could have left something in the will but wasn’t, don’t regret it after the fact and make amends in some other way so no one feels slighted.

Make sure not to forget about what happens if you were incapacitated before having an inheritance distribution event take place. There might need to be another person appointed as guardian for your minor children while they wait until their twenty-first birthday (or eighteen) depending on which state you live in.

Don’t Do This On Your Own

When considering estate planning, it’s crucial to understand the intricacies of wills, trusts, and LPAs (Lasting Power of Attorney). Seeking professional advice from experts like those at Wills Trusts LPA can provide invaluable insights into navigating these legal instruments effectively.

Never try doing this on your own. You are unlikely to know everything about estate planning so you will need to rely on a professional for this one. It’s crucial to get in contact with a reputable estate lawyer who has the experience and expertise necessary to handle various kinds of situations effectively. Remember to always check references before hiring a professional too as not all lawyers excel in their roles and have the experience necessary to assist you.

Don’t consult specific attorneys just because they advertise themselves as being able to help you out there; not even if they have made deals with other people that were satisfied by them (even though it’s true).

Estate planning is an important process everyone needs to go through at one point. Get a ladybird deed and designate the recipients while also taking inventory of all documents. Ensure that you never procrastinate and never leave anyone or anything out because it creates confusion. Finally, never do these things on your own. An attorney will guide you through the process and you’ll make sure everything’s in its place. Good luck!